Annual Data Analysis of Ammonium Sulfate in China in 2022

Release time:

2023-01-12 13:55

Source:

Longzhong Information

Annual Data Analysis of Ammonium Sulfate in China in 2022

2018-2022 Annual Capacity and Supply Structure Fluctuation Trend Analysis

In 2022, the domestic ammonium sulfate market experienced ups and downs. The in stock price was at a high level in the past three years. The annual average price was 1394 yuan/ton, up 2.11 year on year. Among them, the lowest point of Shandong coke enterprises in the year was 1056 yuan/ton in mid-August, the highest point was 1740 yuan/ton in mid-March, and the maximum amplitude in the year was 64.77.

Analysis on Market Price Trend of Ammonium Sulfate in China from 2018 to 2022

In the past five years, the national average price trend of ammonium sulfate in China has shown an inverted "M" trend, and the characteristics of "the peak season is not prosperous, and the off-season is not light" have become more and more obvious. Domestic ammonium sulfate price drive in the cost logic and supply and demand logic between the continuous conversion, 2018-2022, to coking grade ammonium sulfate price, for example, the domestic ammonium sulfate national average price low point appeared in mid-February 2020 near 340 yuan/ton, the price high point appeared in late October 2021 2045 yuan/ton.

2018-2022 Annual Capacity and Supply Structure Fluctuation Trend Analysis

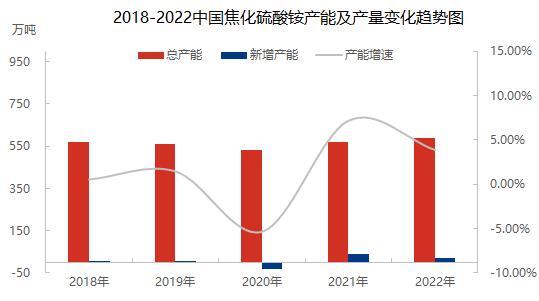

The compound growth rate of China's coking ammonium sulfate production capacity in 2018-2022 is 0.95. In terms of stage, 2018-2020 is the 13th Five-Year Plan period, the elimination of backward production capacity is put on the agenda, Hebei, Shanxi, Shandong to accelerate the longer furnace age, poor furnace condition of the carbonization chamber height of 4.3 meters coke oven pressure reduction work. Ammonium sulfate production capacity will increase by only 260200 tons to 5.68 million tons in 2021, with an industry production capacity growth rate of 7.17. In 2022, due to the large elimination of the industry in the early stage, some new production capacity will be released this year. However, due to the influence of the external economic environment and the narrowing of profits in the industry, the commissioning time of some units has been delayed, and the realization of the new production capacity is expected to be poor, but the overall industry growth rate has increased to a certain extent.

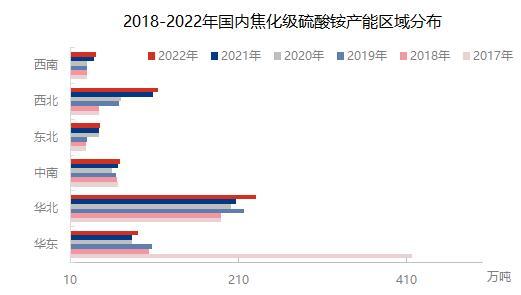

From the changes in the regional distribution of ammonium sulfate in China in the past five years, it can be seen that North China has always been the main producing area of ammonium sulfate in China, and the rich raw material resources and downstream consumption end are the main reasons to support the development of local ammonium sulfate production capacity. The northwest region has grown rapidly in recent years, mainly relying on the upgrading of coke ovens to drive the expansion of production capacity of coke enterprises. The production capacity of East China has declined significantly in the past two years. On the whole, in the past five years, the distribution area of domestic ammonium sulfate production capacity has shown diversified characteristics, but from the perspective of the proportion of production, it is still dominated by North China and East China, and other regions are assisted. Distribution pattern.