Changes in global fertilizer trade

Release time:

2023-03-16 15:32

Source:

New Nongming

In 2022, Russia and Ukraine will occupy an important position in the global food, energy and fertilizer markets. After the crisis, the supply of major food crops and fertilizer markets in the world was interrupted, threatening global food security.

More than a year has passed, expectations of shortages caused by the conflict are fading, and although domestic food prices are still high in many low-income countries, international food prices are generally beginning to moderate. Today, we turn our attention to the international fertilizer market to see what has happened this year, and what the future impact is on agricultural production and food security?

The good news is that fertilizer prices, while still high, have fallen significantly from their peak in 2022. As with global trade in food crops, this rise and fall is a complex story of changing supply and trade links.

In 2020, the unprecedented neo-crown pandemic led to a decline in fertilizer demand, but with the lifting of restrictions and rising international food prices, fertilizer demand began to rebound in early 2021. On the supply side, the rising prices of natural gas and coal, the rising prices of the main raw materials and energy for fertilizer production, and the decline in global fertilizer production capacity have all increased the pressure on fertilizer prices to a certain extent. Before the Russian-Ukrainian crisis, fertilizer prices It is already at a relatively historical high.

International Fertilizer Price Trend

Subsequently, on February 24, 2022, the geopolitical conflict between Russia and Ukraine broke out, and fertilizer prices rose sharply.

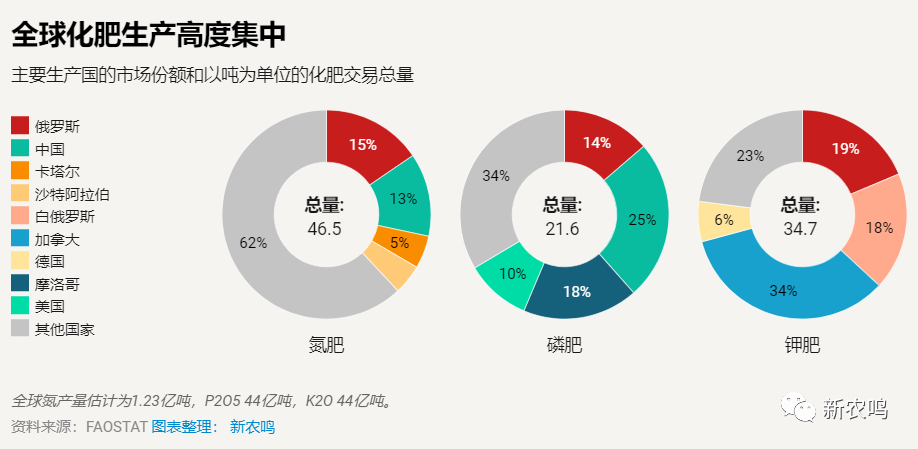

Russia and Belarus are important exporters of nitrogen, phosphorus and potassium, the three major fertilizer nutrients: in 2020, Russia accounted for 14% of the global trade in nitrogen fertilizers and 11% of the trade in phosphate fertilizers, while Russia and Belarus together accounted for 41% of the global trade in potash fertilizers. The highly concentrated nature of fertilizer producing countries determines that the fertilizer industry chain is most vulnerable to the impact of international trade.

Global fertilizer production is highly concentrated

Countries that are heavily dependent on fertilizer imports from Russia and Belarus have had to look for alternative sources from a very tight global market for fear of impending fertilizer shortages. But with about 3/4 of the world's countries importing at least 50 percent of their fertilizer consumption, the trade shock from the conflict reverberates around the world.

At the same time, the turmoil in the natural gas market and soaring prices after the Russian-Ukrainian crisis also contributed to the rise in fertilizer prices.

In order to maintain domestic production and fertilizer supply, large fertilizer producing countries began to implement export restrictions, which also contributed to the rise of fertilizer prices to a certain extent. These include outright bans or onerous export inspections. According to IFPRI statistics, about 20% of the global fertilizer trade has been affected by such restrictions.

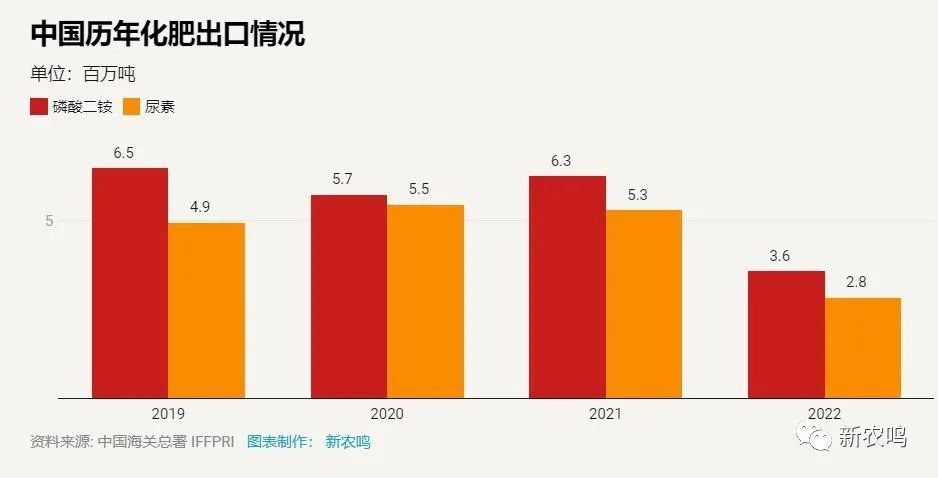

For example, since 2021, China began to implement legal inspection of fertilizer exports, taking diammonium phosphate as an example, China's diammonium phosphate exports accounted for about 30% of global trade, but in 2022 and 2021 compared to exports fell by 43%, while urea exports fell by 47% over the same period.

China's Fertilizer Export Over the Years

Countries that rely heavily on Russian and Belarusian fertilizer imports have had to get supplies from other sources. For example, Brazil, the world's second-largest importer of potash, managed to increase imports from Canada to help offset the decline in imports from Belarus; Morocco, the world's fourth-largest importer of ammonia, increased imports from Saudi Arabia and Egypt to compensate for the decline in imports from Russia.

At the same time, production capacity in some regions has increased with exports, notably potash in Canada and phosphate in Morocco, and urea in Nigeria. Although Russia's fertilizer exports to previous countries have decreased, exports to some markets such as India have increased significantly.

However, some smaller low-income countries in sub-Saharan Africa have difficulty obtaining fertilizer because of problems in the supply of fertilizer after the Russian-Ukrainian crisis. According to the International Fertilizer Association (IFA), global fertilizer consumption will drop by 5% in 2022, but fertilizer consumption in sub-Saharan Africa may drop by 25%, reversing the consumption level of the mid-2010s.

During 2022 and 2023, the supply of fertilizers to the global market will increase and international fertilizer prices will continue to decline, but due to the limited decline in domestic prices, many African countries will still not be able to afford it. Even in the absence of price pressure, fertilizer prices are generally higher in Africa than in other parts of the world, as transport infrastructure and regulatory bottlenecks remain severe.

Possible implications for agricultural production and food security

For agricultural production, the impact on yield depends not only on the amount of fertilizer used, but also on changes in fertilizer selection. The effects of reduced nitrogen fertilizer use on yield are evident during the same growing season, while the effects of K and P fertilizer skimming on yield and soil health may take several years to become apparent. During periods of high fertilizer prices, farmers are more inclined to use nitrogen fertilizers, so global demand for potash and phosphate fertilizers has fallen sharply.

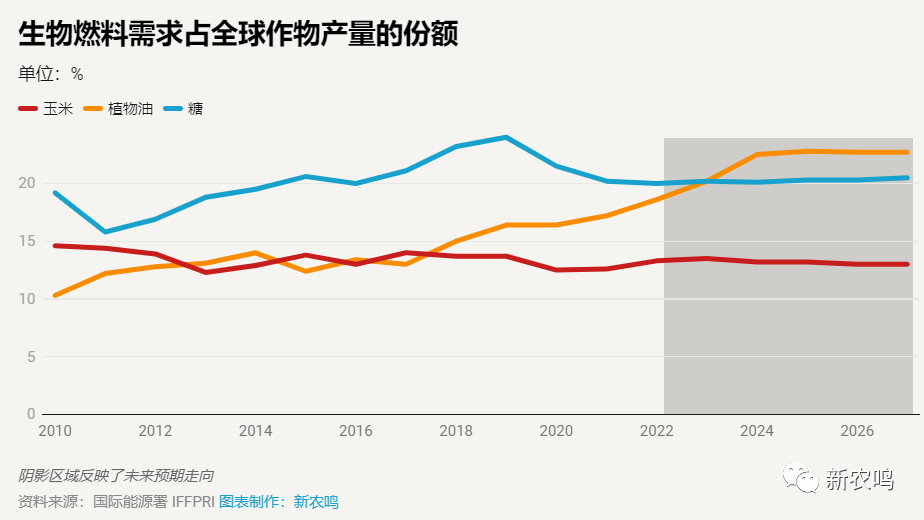

The impact of reduced fertilizer consumption on food security is difficult to assess. Because food production is affected by many factors. Climate-driven events, such as droughts, floods or high post-harvest food losses, can reduce productivity even if sufficient fertilizer is applied. Fertilizers are also used to produce non-food crops, especially for biofuels. Global biofuel production is still growing, albeit at a lower rate since 2020, and overall still relies on food crop feedstocks rather than advanced non-food crop feedstocks. For example, nearly 38% of the corn crop in the United States is used as feedstock for biofuel production, and global vegetable oils are expected to account for about 23% of biofuel feedstock by 2027.

Fertilizers are also used to produce raw materials for biofuels.

According to some agencies, high fertilizer prices and limited availability may encourage farmers to plant cash crops in further preference to food crops. For example, in some countries in Africa, fertilizer has been used heavily to grow cash crops such as coffee, tea, sugar and tobacco. Although this may increase farmers' income, it cannot increase food crop production. Therefore, it will be important to assess how farmers will distribute fertilizer in 2022.

International fertilizer prices lower, what will happen next?

High prices in 2022 have led to reduced end demand (or demand destruction), which in turn has brought fertilizer prices down from last year's peak. However, as fertilizer prices continue to fall, the International Fertilizer Industry Association predicts that global demand will increase by 3% in 2023.

However, when measured against historical averages, fertilizer prices remain high and domestic price inflation persists in many countries. For example, in China, although international fertilizer prices continue to fall, but the decline in domestic prices is limited. As a result, the fertilizer industry remains vulnerable to further shocks from the Russian-Ukrainian crisis or other developments in an uncertain global market environment.

Increased capacity can ease supply concerns, but there are still many uncertainties in 2023. In particular, the following factors will have a profound impact on the global fertilizer market: in 2023, new ammonia production capacity in the United States is expected to be put into production; China's relaxation of export restrictions will also have a significant impact on the global market; Reopening the Russian ammonia pipeline will bring more ammonia supply to the global market; Under the mediation of the United Nations, the ongoing negotiations on the extension of the Black Sea Food Export Initiative (due to expire on March 18), also included are discussions on ammonia pipeline exports; Belarusian potash exports could also increase if EU sanctions are eased.

Global Fertilizer Trading Map

Overall, the outlook for the fertilizer industry is brighter in 2023 than in 2022, but the fertilizer industry itself remains vulnerable to trade and energy shocks, and conflict and other global issues will continue to pose serious risks to fertilizer supplies.

At the same time, the industry faces significant long-term problems. These include the huge dependence of ammonia production on fossil fuels and the search for viable alternatives (such as green ammonia produced by electrolysis powered by renewable energy sources). Fertilizer use remains inefficient in many parts of the world, with negative impacts on soil, water and climate change. This problem can be solved by improved fertilizer application, specialty fertilizers and bio-fertilizers and other solutions. Organic fertilizers need more innovation and promotion to be widely used, as does integrated nutrient management combining organic and mineral fertilizers.

In general, countries and international organizations should find a balance between crisis-oriented repair and long-term industry transformation.